Without any effort or cost to you

Overpayment Check – More Than Just Finding Duplicate Payments

A modern overpayment check goes far beyond identifying duplicate payments. Today’s analysis of the accounts payable process uncovers a wide range of hidden overpayment types — including incorrectly recorded or missing input VAT deductions, supplier credit notes not processed, unclaimed rebates and annual bonuses, payments to incorrect recipients, or misposted import VAT.

What Does an Overpayment Check Mean for You?

- Cost efficiency: Identify payment errors, recover lost amounts, and prevent future overpayments.

- Process assurance: Verify whether processes are consistently followed as designed.

- Risk and fraud prevention: Detect control gaps, mitigate risks, and strengthen your internal control framework.

- Immediate financial impact: Recover overpayments, overbilling, missed discounts, and unclaimed tax deductions to improve your results.

- Benchmarking: Compare your process performance against industry best practices.

- Operational excellence: Enhance the efficiency and performance of your Shared Service Center.

- Quality validation: Have the high quality of your SSC confirmed through an independent external review — “do good and talk about it.”

- Automation review: Ensure that your automated processes run accurately and deliver the expected results.

- Fewer exceptions, fewer manual interventions: Reduce deviations in invoice processing and improve straight-through rates.

- Process integrity: Eliminate recurring errors and bottlenecks in (semi-)automated workflows.

- Discover saving potential: Identify cost-saving opportunities via feedback on contractual terms and contract components.

- External, objective view: Benefit from over 20 years of experience and best practices from many organizations.

- Transparency across the value chain: Gain full visibility, uncover weaknesses, and optimize operations — from procurement to payment.

- Proactive risk management: Minimize supplier risks based on our analyses and create a smoother, safer procurement process.

Additional Insights: We identify root causes, optimization areas, and benchmarks in your accounting and P2P processes.

Unplanned recoveries: Receive refunds from previously undetected overpayments (e.g. duplicates, wrong postings, or missing credit notes).).

Data security guaranteed: 100% compliant with GDPR (EU) and other data protection regulations e.g. of USA, United Kingdom or Switzerland

No workload for your team: We manage the entire project — from data extraction to supplier reconciliation and recovery realization. Your team only joins brief update meetings to review progress.

No financial risk: Our work is fully success-based — our fee is derived solely from the recoveries achieved for you. No cure, no pay.

Why we are confident in the success of an overpayment check

Our confidence is based on experience and precision. Averdes has the capability to analyze data from any ERP system, regardless of volume, language, or source systems. The greater the complexity, the more we welcome it.

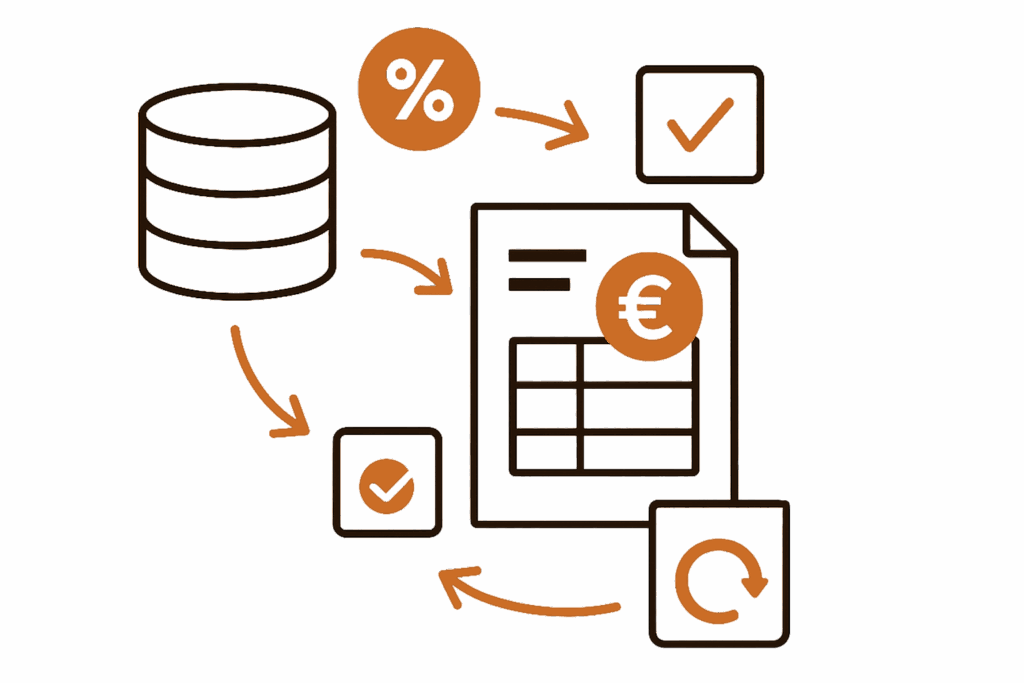

We use our proprietary analysis software with a self-developed algorithm to detect anomalies in your data. This technology is built on over 850,000 supplier records and 80,000 identified error patterns — providing a level of benchmarking and accuracy unmatched by conventional tools.

Our experts follow a proven audit methodology: They quickly detect potential irregularities, separate already corrected cases, and coordinate closely with you to validate genuine overpayments.

Our analyses give you deeper insight into your data and processes:We help you identify overpayments such as duplicate payments, missed discounts and rebates, or tax posting errors precisely and efficiently.

Our analysts are highly qualified professionals with decades of experience across industries. They understand the root causes of P2P-related issues and possess detailed knowledge of tax and deduction mechanisms in global markets.

Competence, proven success, and responsibility to our clients

Our approach

Following a thorough analysis of your accounting data, we identify findings from currently around 850 categories of overpayments — approximately 50 of which relate specifically to duplicate payments. Once you have reviewed and approved the results, we can — if desired — handle the full supplier reconciliation and recovery process on your behalf. Your internal teams remain free from additional workload. At the end of the project, you receive a comprehensive reporting package, including both a detailed project report and a concise management summary of key findings:

Key performance indicators for your accounts payable process

Recurring error patterns and their root causes

Assessment of process stability

Benchmarks and comparisons with peer companies

Recommendations for further optimization

How does it work? We’d be happy to show you.

How high is the risk of duplicate payments for you?

Empirical studies by the American Institute of Internal Auditors (IIA), based on international data, found that for every 1,000 supplier invoices, an average of 1 to 2 accidental overpayments (duplicate payments) occur.

Sounds like a small number? With 300,000 invoices per year and an analysis covering three years, this would amount to 3,000 – 6,000 overpayments. Do you believe your process is secure and that overpayments payments are impossible in your company?

That’s a common assumption. However, we always find something. Over the past 12 years, we have conducted approximately 900 projects, and in every case, we uncovered previously unknown overpayments. Refunds ranging from €500,000 to €4,500,000 are not uncommon.

And what if we don’t find anything?

It’s simple: If we don’t find any overpayments, you’ve received a free validation of your processes—at no cost to you.

You want to find out more?

Competence, proven success, and responsibility to our clients

Account reconciliations that strengthen your supplier relationships

Gain valuable insights and benchmarking data on your procure-to-pay process and supplier behavior.

Our approach is straightforward: We reconcile your accounting records with those of your suppliers to identify unknown credit notes, unclaimed discounts, and outstanding rebates.

Our dedicated teams invest the necessary time to contact every active supplier included in the check — in their local language, ensuring complete and global coverage.

This process not only leads to additional recoveries and financial improvements, but also strengthens your supplier relationships through transparent communication and improved collaboration. In the end, you benefit from both stronger partnerships and greater efficiency and stability within your accounts payable processes.

How does it work? We’d be happy to show you.

FAQs

Tools like Celonis or IDEA are useful and often provide a first overview of optimization potential before clients approach us for a deeper review. However, there are three main reasons why Averdes achieves broader and more detailed results:

- Process mining typically covers only 5–10% of the overpayment types we identify.

- It relies primarily on statistical data analysis, while we combine these insights with our experience databases, direct supplier reconciliations, and the expert judgment of our auditors.

- Process mining provides data — but not the execution. We go further: validating findings, contacting suppliers, documenting results, and securing the recoveries.

Process mining can therefore be a great starting point. If it already reveals some irregularities, an Overpayment Check will almost always uncover significantly more.

Common causes include complex procurement processes, high transaction volumes, organizational changes, supplier transitions, staff turnover, or incomplete system integrations. Other contributing factors are unclear internal guidelines, different ERP systems, or even simple human error — both on the client’s and supplier’s side.

Typical findings include: Duplicate or multiple payments (including triple or quadruple payments) Wrong or excess payments; Missing or unprocessed credit notes; Discounts and rebates not applied; Incorrect postings of special prices or tax components; Missing bonuses or marketing contributions (especially in retail).

If you wish, you can identify relevant contacts in advance (e.g. AP manager, SAP support) and check with IT how long a limited data export from your ERP system would take. The simplest option: schedule a short 15-minute video call with our team. We will guide you step-by-step through the few preparations needed.

We require only a limited extract of your accounts payable transactions and master data. Our team supports you with clear export instructions and best practices.

We fully comply with GDPR (EU) and equivalent privacy laws in Switzerland and the U.S. All projects include NDAs and Data Processing Agreements, secure transfer via Azure infrastructure, 24/7 monitoring, and strict regional data isolation. Your data is processed exclusively through encrypted and regionally compliant channels.

We guide your IT team through the secure extraction and upload process. Alternatively, we can perform the export ourselves with the appropriate read-only access rights.

Usually, the first check is a one-time project. However, many clients repeat it every 1–3 years, due to its effectiveness and low internal effort.

We also recommend a new check after major process or system changes, mergers, system upgrades, or significant staff turnover.

For large organizations, a continuous overpayment check can be implemented — running permanently in the background to detect and correct errors almost in real time.

Typical average client involvement:

- IT / ERP support:

Initial export and access setup: 2–6 hours (one-time)

- Accounting Team

Review & approval of results: 4–8 hours (one-time)

Project communication & coordination: 0.5–1 hour per week

- Management:

Final results presentation: 1 hour (one-time)

Most projects last two to five months — from kick-off to the recovery of funds. Repeat projects can often be completed within a few weeks.

Most projects last two to five months — from kick-off to the recovery of funds. Repeat projects can often be completed within a few weeks.

Identification of past payment errors Reduction of financial and operational risks Supplier discipline through process transparency KPI benchmarking and best-practice comparison Actionable insights for process optimization Immediate financial returns from recovered funds

Ideal for organizations with high transaction volumes, including: Retail and Consumer Goods Banking and Insurance Manufacturing and Energy Telecommunications and Media Pharmaceuticals and Healthcare Public Sector and Utilities

Every organization processing a significant number of supplier transactions can benefit from verified cost savings, improved controls, and greater transparency.

It is a permanent monitoring solution, checking transactions nearly in real time. This allows immediate error correction, proactive risk reduction, and faster recoveries — especially valuable for large organizations or complex supplier networks.

We perform Overpayment Checks on any ERP system. We standardize, consolidate, and normalize the data to ensure a unified, comparable analysis.

No direct system access is required. If preferred, we can handle data extraction ourselves—with read-only rights. We’re happy to explain the details.

Our projects are powered by proprietary software, enhanced by over 12 years of experience, data on 850,000+ suppliers, and insights into 80,000+ error types.

Conditions Check

Commercial conditions are often complex, and unclaimed credits are easily overlooked. We identify outstanding rebates, sales bonuses, return credits, and marketing contributions (WKZ) that you are still entitled to — and recover them for you.

Risk Check

In a world of multiple crises, stable supplier relationships are essential. Our analysis detects hidden risks such as potential corruption, sanction violations, or payment defaults among your business partners — helping you protect your company’s integrity and continuity.

Fraud check

Internal or external irregularities can cost companies millions each year. Our Fraud Check uncovers potential cases such as fictitious invoices, payment fraud, or kickbacks and strengthens your internal control framework against future threats.

Insolvency Support

An insolvency brings major challenges — we assist you in managing them. Averdes supports you with accounts receivable management, recovery of open credits, and the purchase or settlement of claims – if desired, on a success-based model only.

External Audit Support

Your internal audit team may need assistance in reviewing commercial processes — for example in Accounts Payable (P2P) or Procurement. We contribute 20+ years of audit experience and data analytics expertise to help you achieve transparency, compliance, and measurable improvements.